The purchase of a home is a significant financial commitment, often representing one of the largest investments you’ll ever make. Protecting this investment is crucial, not only for your peace of mind but also for ensuring that your loved ones are not burdened with financial stress no matter what happens in the future. Life insurance is a powerful tool for safeguarding your mortgage and providing long-term security for your family.

Homeownership often relies on the combined financial efforts of couples or co-owners. That’s why it’s prudent for all parties involved to secure insurance coverage, ensuring the continuity of homeownership regardless of unforeseen circumstances. But which type of coverage best meets your needs: term life insurance or mortgage insurance?

Mortgage Insurance: Convenient but Costly

While mortgage insurance offered by lenders provides ease of acquisition and minimal qualification requirements, it often comes at a premium. Most homeowners who opt for lender-provided mortgage insurance could secure more favorable rates through term life insurance from dedicated insurers.

Many of our clients who have purchased mortgage insurance from the bank were able to secure much more attractive rates through term insurance we offered them and ended up not only saving thousands of dollars over the years, but had much better insurance protection too.

Term Life Insurance: A Superior Choice

Here are four compelling reasons why term life insurance typically outperforms mortgage insurance:

1. Cost-Effectiveness

Term life insurance premiums are tailored to your individual health and financial profile, often resulting in lower costs compared to the one-size-fits-all approach of mortgage insurance.

2.Better Value

Unlike mortgage insurance, where coverage decreases as your mortgage balance drops, term life insurance maintains a fixed benefit amount throughout the policy term.

3. Beneficiary Control

Term life insurance pays directly to your chosen beneficiaries, allowing them to allocate funds as needed. Mortgage insurance, conversely, pays the lender directly, limiting your family’s financial flexibility.

4. Portability

Term life insurance remains with you regardless of changes in your mortgage or lender. Mortgage insurance, however, may require repurchasing if you switch lenders, potentially at higher rates due to age.

A Comparative Example

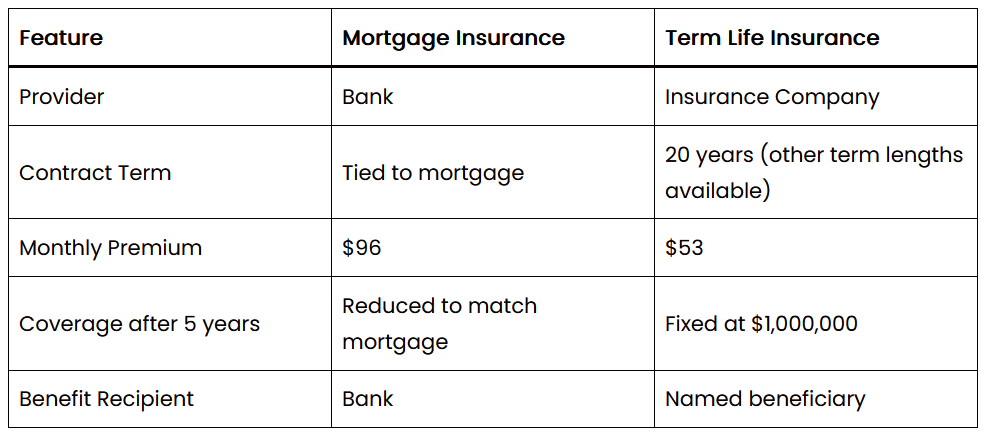

Consider this comparison for a 35-year-old male seeking $1,000,000 in coverage:

As illustrated, term life insurance offers nearly 50% savings in premiums while maintaining full coverage and providing greater flexibility.

In Conclusion

For those in good health, individual term life insurance often presents a more competitive and flexible option for protecting your home and loved ones. If you currently hold mortgage insurance, it’s worth exploring term life insurance alternatives to potentially secure better coverage at a lower cost.

If you’d like to continue the conversation on this subject, please contact us.

Sources:

1. Sun Life https://www.sunlife.ca/en/insurance/life/mortgage-insurance-vs-life-insurance/

2. CIBC mortgage insurance rate calculator for mortgage rates https://www.cibc.com/en/personal-

banking/insurance/creditor/mortgages/life.html

3. Life Guide broker quoting system for life insurance rates